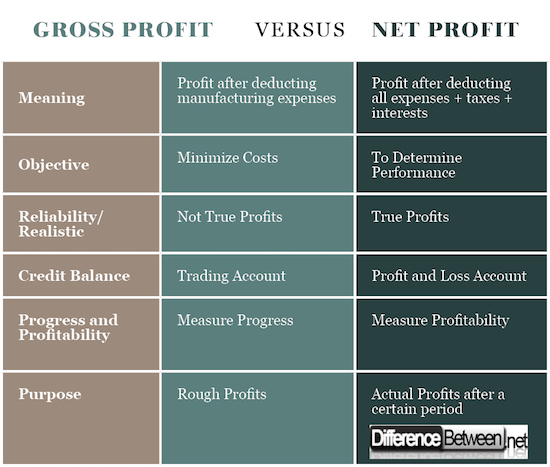

FreshBooks is an affordable option for freelancers and small service-based businesses that operate mostly on the go. Compared with free software like Wave, QuickBooks plans are expensive. The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace. There are also add-on Intuit services like QuickBooks Payroll or QuickBooks Time. Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments.

Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags. It has a handy What is a General Ledger GL WordPress-style dashboard on the left side of the screen. The dashboard has large, easy-to-click buttons that are easy to use from any type of device.

Businesses

Import your customers, vendors, products/services, invoices, and chart of accounts from Wave accounting software to Akaunting in just a few clicks. Wave Payments makes it easy to accept payments online. With Wave Accounting, you can securely accept payments, track invoices, manage customers and more.

Quick Create Option

The option to quick-create transactions, contacts, and items are present in Wave’s Dashboard. In Zoho Books, the option to quick-create transactions, contacts, and items are present in the top bar. It can be accessed from any screen of Zoho Books enabling you to create transactions faster. I thought “geolocation failed?” so I tried to access via VPN – same thing. Not even mentioning that many business owners travel and need access from abroad, and there are plenty of foreigners who own businesses in the US.

Remove business growth restrictions

Enhance your experience with the Wave desktop app for Mac and PC on WebCatalog.

- Full details on how Wave support works are available here.

- Enhance your experience with the Wave desktop app for Mac and PC on WebCatalog.

- Support for non-paying users is limited to the chatbot and self-service Help Center.

- Akaunting eliminates borders, localizing your customer experience in 100+ countries.

The free financial management software is user-friendly and equipped with all the basics, including income and expense tracking, bank connections, invoicing and reporting. Email invoices with a secure “Pay Now” button after you’ve turned on the online payment option. Customers can pay instantly by credit card or secure bank payment (EFT) when they view the invoice online. You can review and approve payroll in just a few clicks.

They do offer text support, but you will have to wait up to one hour or longer in the que. Then the staff, although polite, are not knowledgeable enough to help. Yes, I can create a new company with proper accounts set up. Google Analytics is a service offered by Google that generates detailed statistics about a website’s traffic and traffic sources and measures conversions and sales. Google Analytics can track visitors from all referrers, including search engines and social networks, direct visits and referring sites.

This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. Now you have a Wave account, next is to add a password to your account. You can do this by clicking on the name of your business in the top-left corner of the screen and clicking on Manage your profile. One of the options there will let you add a password to your account.

If you are on the go or out of the office frequently, this accounting tool is for you! The Wave Help Center provides comprehensive customer support for users of Wave’s financial services software. Visit the link for detailed tutorials and answers to commonly asked questions. Using this bulk data export option, you will be able to export all your transactions, bills, customers, and vendors as a ZIP file in CSV or Excel format. Also, you will be able to export all the receipts you had uploaded as a ZIP file.

Recent Technology Changes in my.waveapps.com

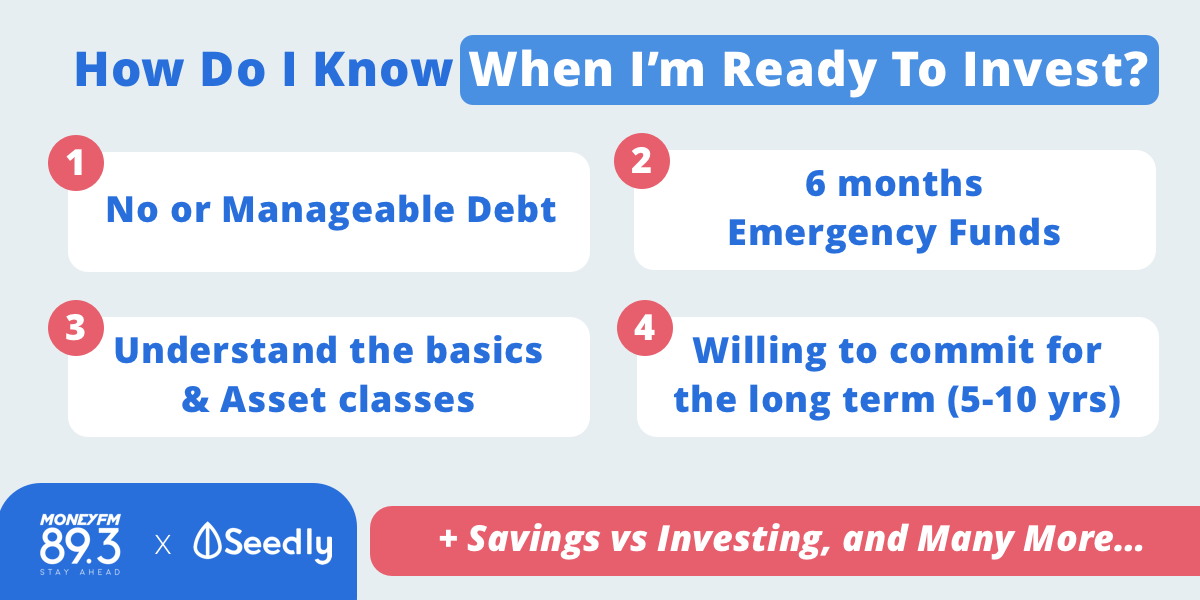

Strong invoicing feature competes with that of paid products; app lets users send invoices on the go; offers significantly fewer reports than competitors; no inventory tracking. Wave Accounting is free, but you will have to pay processing fees if you choose to accept invoice payments online. Wave also offers paid products for payroll, coaching and mobile receipt scanning.

- Automate overdue reminders, set up recurring bills, and add notes or terms of service with ease.

- Several bugs they refuse to fix and very poor communication.

- I had a $15k payout scheduled for today and last minute they decide to flag my account and refund all my clients that have been with me for years.

- This app/addon eases the process of moving your financial data from Waveapps to Akaunting.

Plus, you can get paid faster with online payments. Visit the link to learn more about Wave Payments and how to get started. This limits the growth potential of small businesses. Wave’s invoicing is free and unlimited, with three customizable templates and a user-friendly interface, putting it on par with some of the best invoicing software solutions for small businesses. Other capabilities include recurring invoicing and the option to let repeat clients opt into automatic credit card billing.

Wave: Small Business Software

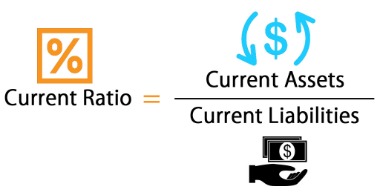

With Payments by Wave, customers can pay straight from the invoices you send them, and the payments automatically sync with your Wave accounting software. At 2.9% + $0.30 per credit card transaction and 1% per bank transaction, Wave’s fees are fairly standard. NerdWallet’s accounting software ratings favor products that are easy to use, have a robust feature set and can grow with your business. Ratings are based on weighted averages of scores in several categories, including scope of features and integrations, customer support and cost, among others. Learn more about how we rate small-business accounting software.

I possess expertise in conducting comprehensive keyword research to identify high-impact opportunities for improving search engine rankings. I am proficient in utilizing AI tools to streamline and enhance the SEO process. In addition to my technical skills, I have a solid understanding of HTML and CSS, which enables me to effectively optimize web pages for improved performance and user experience. I am well-versed in using Microsoft Excel, CMS platforms, Google Search Console, and Google Analytics to gather valuable insights and data to inform optimization strategies. If you’ve added your bank account from the list of bank accounts, the bank feeds will be fetched into Zoho Books automatically. If you added the account manually, you will have to import the bank statements manually.

Next, you can enable the Wave Connect add-on in Google Sheets and download Wave’s data. In Wave, you would have added new users using the available default roles of Admin, Editor, Payroll Manager, and Viewer. Setting up the organization ensures that the correct information about your business or company is used in all the transactions and records. Search

In Wave, you would have had the option to filter and find transactions limited to each module.

Thanks for using Wave to help you stay more in control of your business while on-the-go. Organize apps and accounts into tidy collections with Spaces. Why limit your business growth to two countries when you can grow your small business beyond borders to reach and serve global customers.