Contents:

A valid https://g-markets.net/ wedge should contain at least five touches of the two trendlines, with two touches of one trend line, and three of the other. The rising wedge chart pattern is a bearish pattern, but does occasionally break up to keep traders on their toes and guessing. Certain characteristics that fit the profile of a bearish rising wedge pattern can help traders and analysts validate the pattern and increase the probability of success. Ascending broadening wedge forms when the price makes higher highs that are connected by an upper trendline and lower lows that are connected by a lower trendline. And according to the direction of the trend at the beginning of the wedge formation, you can know whether the trend will continue or reverse.

They are considered to be a continuation or a reversal chart pattern depending on the type of wedge and the previous trend. Moreover, each one of them, wedge patterns, as well as broadening wedges, is categorized into two types. Thereby, we can find a rising wedge pattern and a falling wedge pattern. Similarly, we can find an ascending broadening wedge and a descending broadening wedge. In this course, we will explain what is wedge pattern, learn about broadening wedges, and tell you how to trade them in the forex market.

Bulkowski on Descending Broadening Wedges

The next step is to identify an entry point for your trade. The rule of thumb is to wait for the price to break the trendlines before taking a position. We would enter the market when the broadening wedge breakout occurred. The target for this trade could be the same as the height of the wedge. On the other hand, the right-angled descending broadening wedge consists of a horizontal top followed by a down-sloping trendline.

6 Stock Market Predictions for the Week Ahead – Investing.com

6 Stock Market Predictions for the Week Ahead.

Posted: Mon, 13 Mar 2023 07:00:00 GMT [source]

If the rising broadening wedge pattern breaks out above the resistance line, then the pattern has completed, signalling a new uptrend. In a falling wedge, both boundary lines slant down from left to right. Volume keeps on diminishing and trading activity slows down due to narrowing prices. There comes the breaking point, and trading activity after the breakout differs. Once prices move out of the specific boundary lines of a falling wedge, they are more likely to move sideways and saucer-out before they resume the basic trend.

Descending Broadening Wedge: Example

This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well. In Thomas Bulkowski’s Encyclopedia Of Chart Patterns, only 6% of the formations breaking out downward will fail to continue moving down by more than 5%. Also there is a 76% chance that the formation will break out downward. The first and most important thing to consider are the time frames you will use.

Wedges are often accompanied by falling volume within the pattern, which then returns as the market breaks out. When we trade broadening formations, we have no choice but to break. Because the trend was losing steam and a reversal was likely to occur, we could look for a short entry when the price broke outside the formation. The break-out from the wedge formation is often accompanied by an increase in trading volume, which can confirm the strength of the move.

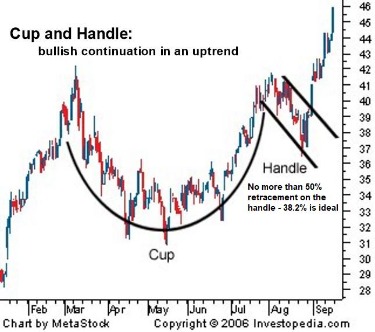

A double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Figure 1 shows a rising wedge on a 60-minute chart, while a bear chart pattern is evident in the daily chart. Using two trend lines—one for drawing across two or more pivot highs and one connecting two or more pivot lows—convergence is apparent toward the upper right part of the chart . Hence, once we identify the wedge, we process towards the second stage when we look at the trade elements – possible entry, stop loss, and take profit. In between these two, the volume is decreasing as the wedge progresses.

A broadening formation is a technical chart pattern depicting a widening channel of high and low levels of support and resistance. A rising wedge is often considered a bearish chart pattern that indicates a potential breakout to the downside. The main strength of an ascending wedge pattern is its ability to warn us of an imminent change in the trend direction.

Head and Shoulders Pattern: The Ultimate Guide [2023 Update]

Like other wedges, the pattern begins wide towards the bottom and contracts as the price moves higher and the trading range narrows. However, the indicator is the opposite of a falling wedge that indicates potential upside. The rising wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. It’s the opposite of the falling wedge pattern , as these two constitute a popular wedge pattern. A rising wedge can be both a continuation and reversal pattern, although the former is more common and more efficient as it follows the direction of an overall trend.

A trend is the general price direction of a market or asset. Determining the trend direction is important for maximizing the potential success of a trade. Visit the visual chart pattern index to hunt for other chart patterns.

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

Volatility grows throughout the pattern, as bulls and bears battle to take control. You’ll still want to confirm the trend, though, with a red candlestick after the breakout or by looking at indicators. We have been producing top-notch, comprehensive, and affordable courses on financial trading and value investing for 250,000+ students all over the world since 2014. This is why many technical analysts view them as potential turning points in the market.

Here, the slope of the support line is steeper than that of the resistance. Experience award-winning platforms with fast and secure execution. This is a warning sign that the buyers are losing interest and that the trend is going to reverse. However, you will need to stay flexible until the formation fully develops. Each trend-line should have a minimum of three touches, or close to that.

A good rule of thumb is to place your stop at the market’s last significant low – the last time it bounced off the resistance line that forms the bottom of the pattern. If the price moves below this point, then the pattern has clearly failed and it’s time to get out. Typically, traders will wait to confirm the uptrend before executing their order.

Falling wedge

Whenever we talk about wedge patterns, it’s important to differentiate between broadening versus narrowing formations. Notice that we have a support and resistance level as well as the price action that forms the consolidation. What makes it a “broadening” pattern is, of course, the fact that the two levels are further apart at the end than they are at the beginning. If the pattern’s height is short you can sell after breaking the support line and put your stop-loss above the resistance line, and your take-profit should be at the starting level.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

I think you’ll be surprised at how often the objective matches up with a predefined level of support or resistance. Just like the narrowing wedge, a broadening wedge has a built-in objective we can use to identify a profit target. For example, a broadening wedge pattern on a 1-hour chart would require a 1-hour close beyond the upper or lower boundary. Typically a continuation pattern but can sometimes trigger a reversal. The formation usually occurs after an extended move up or down where price “coils” before eventually breaking out. Identifying a Right-Angled Broadening Wedge Right-Angled Broadening Wedges come in two varieties, ascending and descending.

From beginners to experts, all traders need to know a wide range of technical terms. If you want to go for more pips, you can lock in some profits at the target by closing down a portion of your position, then letting the rest of your position ride. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. For more information on this pattern, readEncyclopedia of Chart Patterns, pictured on the right, pages 98 to 114.

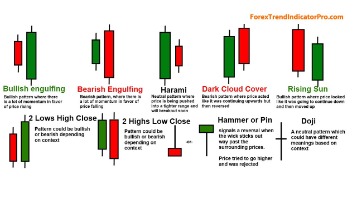

These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. 📍Bear Flag 🔸 A small rectangular pattern that slopes against the preceding trend 🔸 Forms after a rapid price decline… The rising wedge pattern is a formation that looks like the opposite of a falling wedge.